Heliodoor Property Consultants

The Essential Landlord's Guide to the Renters' Rights Act 2025 and Autumn Budget Impact

UK landlord’s guide to the Renters’ Rights Act 2025, Budget 2025 tax changes and a practical pre‑letting legal checklist to keep your rental properties compliant

The Renters’ Rights Act 2025 and Budget 2025 together reshape how UK landlords let, manage and profit from rental property. This guide explains how the new renters’ rights rules affect landlords, what Budget 2025 means for landlords and property investors, and provides a practical landlord pre‑letting checklist so you can meet all key legal obligations before renting out a property in the UK.

Renters’ Rights Act 2025 – key changes for UK landlords

The Renters’ Rights Act 2025 introduce major reforms to the private rented sector in England, with core tenancy changes scheduled to begin on 1 May 2026. For landlords, this means new rules on how tenancies are structured, how you can regain possession, and how rent can be increased.

Key points for landlord responsibilities under the Renters’ Rights Act 2025 include:

Section 21 is abolished, with all routes to possession moving to strengthened and clarified Section 8 grounds.

All assured tenancies become periodic, with tenants able to remain indefinitely and end their tenancy with notice, while landlords must rely on statutory grounds to regain possession.

A new national Private Rented Sector database and mandatory landlord Ombudsman will be phased in from late 2026 onwards, with registration and membership becoming legal requirements.

Possession, Rent and Tenant Protections

The Act balances stronger tenant security with defined circumstances where landlords can still recover possession.

Headline points:

Updated mandatory and discretionary possession grounds cover landlord or family occupation, sale of the property, serious and persistent rent arrears, and anti‑social behaviour, with clear notice periods.

All rent increases must use the statutory Section 13 process, with a limit of one increase per year and the right for tenants to challenge above‑market rises at the First‑tier Tribunal.

“Rental bidding” (accepting offers above the advertised rent), blanket bans on tenants with children or benefits, and unreasonable refusals of pet requests are restricted, backed by civil penalties for breaches.

Key Implementation Timeline:

· 27 December 2025: New enforcement powers come into force

· 1 May 2026: Core tenancy reforms commence

· Late 2026: PRS Database and Ombudsman introduction

· 2027: Reforms extend to social rented sector

· 2028: Mandatory Ombudsman sign-up deadline

New Tax Landscape: Budget 2025 and what it means for Landlords and Property Investors

The 2025 Autumn Budget introduces targeted tax changes that directly affect unincorporated landlords and property investors from April 2027. Understanding these changes is essential for long‑term portfolio planning and cash‑flow management.

Key measures:

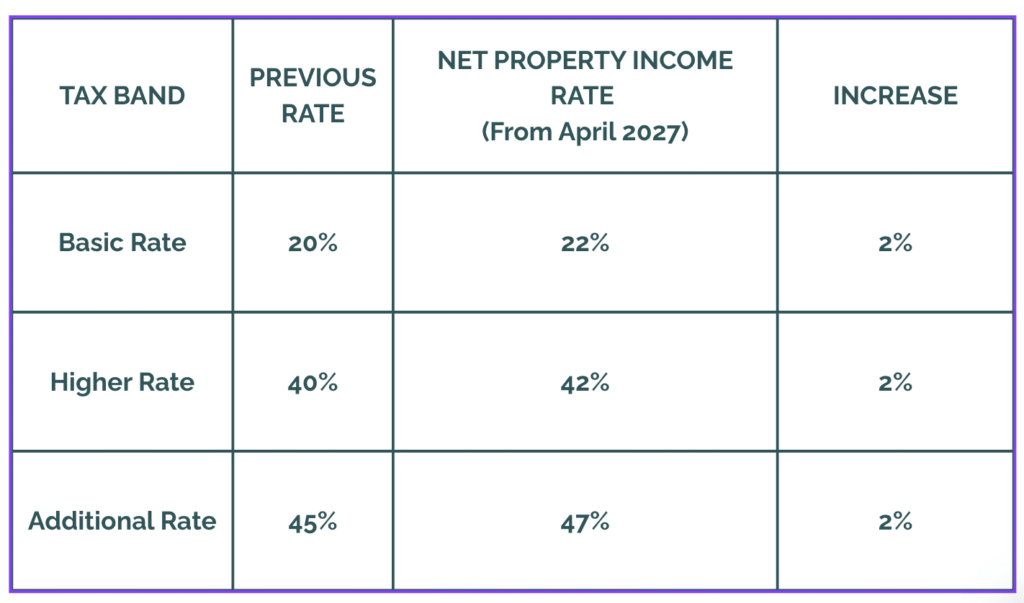

From April 2027, separate property income tax rates will apply, with higher dedicated rates for rental profits than for general earned income, increasing the tax burden on many individual landlords.

From April 2028, a High Value Council Tax Surcharge will apply to residential properties above specified value thresholds, payable by property owners in addition to standard council tax.

These changes sit alongside existing Capital Gains Tax and Stamp Duty Land Tax rules, which remain central considerations for buy‑to‑let investors and landlords planning disposals or acquisitions. Taking professional tax advice can help you structure your portfolio in a way that reflects Budget 2025 while remaining commercially viable.

What This Means for Landlords:

When calculating tax on rental income from April 2027:

- Basic rate taxpayers (£12,570-£50,270 income) will pay 22% on property income

- Higher rate taxpayers (£50,270-£125,140 income) will pay 42% on property income

- Additional rate taxpayers (over £125,140 income) will pay 47% on property income

Pre‑Letting Legal Checklist for Landlords (England)

Before granting a new tenancy, landlords must meet core legal duties around safety, information, and tenant checks. The following checklist is drawn from official GOV.UK guidance and is suitable as a repeatable pre‑tenancy process.

1. Property Safety and Standards

- Ensure the property is free from serious health and safety hazards in line with the Housing Health and Safety Rating System (HHSRS).

- Where gas is installed, arrange an annual gas safety check by a Gas Safe registered engineer and give the latest gas safety record to the tenant.

- Ensure electrical installations are safe and inspected at required intervals, with an Electrical Installation Condition Report (EICR) where regulations apply.

- Fit and test smoke alarms on each storey used as living accommodation, and carbon monoxide alarms in required rooms, on the day the tenancy starts.

2. Energy Performance

- Provide a valid Energy Performance Certificate (EPC) to prospective tenants before the start of the tenancy.

- Check that the property meets the current minimum energy efficiency standards before letting, or that any applicable exemption has been correctly registered.

3. Tenant Information and Documentation

- Put in place a written tenancy agreement setting out key terms, including rent, start date and responsibilities, taking account of the evolving Renters’ Rights framework.

- Provide the latest version of the Government’s “How to rent: the checklist for renting in England” guide, either as a printed copy or as a PDF sent by email, before or at the start of the tenancy.

4. Deposits and Prescribed Information

- If you take a tenancy deposit, protect it in a Government‑approved tenancy deposit protection scheme within the legal time limit.

- Serve the scheme’s prescribed information on the tenant, explaining how the deposit is held and how disputes will be resolved

5. Right to Rent Checks (England)

- Complete a right to rent check for all adult occupiers before the tenancy starts, using acceptable original documents or the online share‑code service where applicable.

- Keep clear, dated copies of documents or online check results to demonstrate compliance and maintain your statutory excuse.

6. Licensing and Local Requirements

- Confirm whether the property needs a house in multiple occupation (HMO) licence or falls under a selective licensing scheme in the local authority area.

- Apply for and obtain any required licence before letting, and comply with any additional conditions attached to that licence.

7. Records and ongoing landlord responsibilities

- Keep organised records of safety certificates, EPCs, licences, deposit protection, right to rent checks and information given to tenants.

- Be prepared to carry out repairs, deal with hazards and maintain the property to required standards throughout the tenancy, including emerging obligations under the Renters’ Rights Act 2025

How Heliodoor Property Consultants can help

Keeping up with the Renters’ Rights Act 2025, Budget 2025 changes and day‑to‑day landlord legal obligations can be time‑consuming. Heliodoor Property Consultants supports landlords with Renters’ Rights implementation, pre‑letting compliance audits and portfolio reviews that take account of Budget 2025 tax changes and UK landlord responsibilities.

If you would like a downloadable copy of our Comprehensive Guide to these changes and how they affect you, please request it HERE.